Set up a 100% tax-free company abroad: How is this possible?

Many people dream of a life without paying taxes! But do you have to go to the United Arab Emirates, for example? What if you don’t live in such a tax haven?

Digital nomads and entrepreneurs also have to pay taxes when setting up a company abroad.

As an entrepreneur, it depends on which country in the world you are in and whether you still have a registered place of residence in Germany. Depending on this, taxes may be due abroad or in your home country.

How do digital nomads actually do it? Not every digital nomad has a company and therefore tries to remain undetected under the radar of the tax system. Others, on the other hand, attach importance to setting up a legal company abroad.

An obligation to pay withholding tax, corporation tax, trade tax or income tax may arise, depending on the country from which you operate.

For this reason, you should think in advance about which country is suitable for your company headquarters and in which country you intend to live.

Would you like to set up an offshore company abroad?

Then the Canada LLP is a good, if not the best decision you can make. LLP stands for “Limited Liability Partnership” and describes the type of company. The Canada LLP is therefore a partnership and must have at least 2 contracting partners. At least on paper. But we’ll come to that later.

Canada is highly regarded worldwide. Therefore, a Canadian company abroad is perfect for living with minimal taxation or even tax-free. The Canadian LLP (Canadian Limited Liability Partnership) offers the opportunity to own a legal offshore company abroad, which is also highly regarded.

Whether you don’t have to pay tax depends on which country you live in.

Who benefits from the Canada LLP corporate form?

- Digital nomads outside and inside Europe

- Online marketers (website developers, online store operators, YouTubers, ...)

- Freelancers such as marketing designers and software developers

- Online coaches who also sell digital info products

- Due to the limitation of liability, also married couples, business partners and friends

For freelancers, online entrepreneurs and digital nomads, the Canada LLP company form is excellent. Because it can be used to create everything that takes place online. This model can therefore also be interesting for Twitch streamers and YouTubers. Website designers, freelancers, ghostwriters and marketing designers who offer their services online, e.g. on “Mach Du Das!” or “Fiverr”, can also benefit greatly from a company in Canada.

A Canada LLP is also ideal if you sell digital information products or operate an online store. You can run all of this through your company in Canada. We list further advantages at the bottom of the article. The Canada LLP is also ideal for setting up a company abroad between spouses, business partners or friends, as no other partner is liable for the actions of one partner. So you don’t have to worry about liability.

Each partner has limited liability and is only liable for their contribution. The contribution can be specified in advance in the partnership agreement. There is no minimum capital requirement for founding a Canada LLP!

Open your own Canada LLP in British Columbia now!

- 100% legal company in Canada!

- Entrepreneurial freedom guaranteed worldwide!

- Run a company from abroad with peace of mind!

- Company structure without withholding tax!

- Perfect for digital nomads!

- Tax-free income abroad!

- Own company and still flexible!

Tax exemption thanks to a company abroad with a Canada LLP?

The mere fact that you own a Canadian company does not mean that you do not have to pay taxes! Before this happens, a few cornerstones need to be clarified.

The first important point concerns residence in Germany.

Are you still registered as a resident in Germany or are you deregistered from Germany?

Deregistered from Germany means that you are not in possession of a key with access to an apartment and have no available place of residence in Germany.

If you are clearly deregistered from Germany and no longer reside there, or if you intend to do so in the near future, then this is already the first important step in the right direction.

Depending on your plans and your financial resources, the next step is to choose a company whose legal form suits you. One advantage of a Canadian LLP is that it is not subject to withholding tax or corporation tax.

This means that all profits that you generate with your Canadian company are simply passed through to you and your partner. However, you must take care of income tax in your country of residence.

And, of course, only if taxes on foreign income are levied in this country of residence.

You should therefore look for a country in which taxation is based on the territoriality principle. This is because in such territorially taxed countries, profits or income from abroad are considered tax-free. More on this in a moment!

5 important points for a life without taxes!

- Be logged out of Germany

- Have no access to an apartment or similar in Germany

- Reasons for a company abroad that does not levy withholding tax

- Live in a country without foreign tax law / add-back taxation / CFC rules

- Live in a country that taxes e.g. territorially or similarly

What is a Canada LLP?

A Canadian LLP consists of at least 2 partners. This Canadian form of company is most comparable to a German limited partnership (KG). With the important difference that in a Canadian LLP there are only partners with limited liability and no general partner. This means that one partner is not liable for the mistakes of the other partner, even if these mistakes result in high costs.

This form of company is particularly popular when founding a law firm between several lawyers. Each individual lawyer is considered a partner or name partner, but is only liable to a limited extent for their own contribution and only for their own fault. A joint practice between several doctors follows a similar principle. Each individual doctor is also considered to have limited liability for his own contribution.

The formation of a Limited Liability Partnership is normally only available to professionals such as doctors and lawyers. However, Canada is made up of several provinces, and each province has its own laws and requirements for setting up a company. So there is one exception, and that is exactly what we are talking about here. What we refer to here as the Canada LLP is actually the British Columbia LLP.

British Columbia LLP: What are the special tax features?

In the Canadian province of British Columbia, it is permitted to register an LLP, e.g. as a freelancer, digital nomad, online marketer or other self-employed group of persons. It is even permitted for legal entities to register an LLP. This is the best way to set up a company abroad.

The taxation of the LLP sets the Canada LLP in British Columbia apart! All profits with the British Columbia LLP are tax-free in Canada, provided that you do not live in Canada and do not do business with Canadian clients in Canada.

In a nutshell: You don’t have to pay taxes in Canada, you don’t have to file a tax return and you don’t have to do any bookkeeping if you don’t have clients in Canada!

Profits and income of a Canada LLP are passed through directly to all partners. This is called a flow-through structure. The partners’ income must be taxed in the country in which they live, are registered or have their permanent residence.

For a country in which the territoriality principle applies, this would therefore mean that all profits of the Canada LLP are 100% tax-free!

World travelers, digital nomads and all those who call the world their home and do not live in a country with residency taxation and foreign tax laws, such as Germany, have a huge advantage.

What is the territoriality principle or territorial taxation?

In a nutshell, the following taxation systems exist worldwide:

- Taxes by citizenship

- Residence taxation

- Territorial taxation

- Non dome system

- Without direct taxes

In the case of taxation according to citizenship, citizens must pay taxes to their home country regardless of where they work or live. This applies, for example, to citizens of the USA and Eritrea.

Residency taxation with foreign tax law applies in many countries. Especially in industrialized nations, such as Germany. As soon as you have a residence in such a country, e.g. Germany, you become liable to pay tax there. This tax liability also includes income from abroad, as well as the fact of running a foreign company. Trade tax and corporation tax are due on your company abroad.

Residency taxation without foreign tax law and add-back rules (CFC rules*) is still offered by around 85 countries. Although there is no trade or corporation tax on foreign companies, you do have to pay some tax on your foreign income. In this case, it is advisable to choose a country where the tax burden on your income is low or does not apply at all.

*Countries without CFC rules are e.g. Belgium, Bulgaria, Chile, Ecuador, Gibraltar, Hong Kong, Ireland, Colombia, Croatia, Luxembourg, Malaysia, Malta, Mauritius, Poland, Philippines, Romania, Saudi Arabia, Switzerland, Singapore, Slovakia, Thailand, Czech Republic, Ukraine, Vietnam, Cyprus and many more.

Territorial taxation is the best way to run a company abroad. With this type of taxation, no trade tax or corporation tax is imposed on companies located abroad. If the income is received from abroad, it is completely tax-free.

In the non-dom system, taxation only applies to those who live in the country and also hold its citizenship. In these countries, foreigners do not have a domicile, but a residence. Foreigners are therefore called non-domiciled and if they own a company abroad, they do not have to pay taxes. This is the case in Ireland and England, for example. English citizens have to pay tax on foreign companies and their income. However, Germans living in England do not have to pay tax on their foreign company!

For example, you do not have to pay any taxes in the United Arab Emirates such as Dubai or other Islamic countries such as Qatar, Saudi Arabia or Oman. There, only partial taxes are imposed on the oil and banking sector.

All the tax systems mentioned have of course been significantly summarized and shortened for this article. There are exceptions and special regulations in every tax system, e.g. in Thailand. If you would like to read more detailed information on the tax systems, you can find one of our more detailed articles on the topic of “Worldwide tax systems” here.

In Thailand, for example, a special regulation applies! Profits, income and dividends that are not transferred to Thailand in the same year in which they are earned are completely tax-free in Thailand.

Open your own Canada LLP in British Columbia now!

- 100% legal company in Canada!

- Entrepreneurial freedom guaranteed worldwide!

- Run a company from abroad with peace of mind!

- Company structure without withholding tax!

- Perfect for digital nomads!

- Tax-free income abroad!

- Own company and still flexible!

What are the advantages of Canada LLP as a company abroad?

- Canadian companies are highly regarded

- No taxation at company level, but at owner level (profit is passed on to the partners!)

- Perfect for business partners and married couples

- Deductible invoices for your business customers B2B

- No withholding tax on income outside Canada

- No corporation tax or trade tax in Canada

- No liability of the partners due to private assets

- Limitation of liability for all partners

- Residence of the partners is irrelevant

- Easy opening of business accounts with FinTech banks such as Wise or Payoneer

- No partner information in the public register

- No minimum capital required

- No obligation to file a tax return if there are no clients in Canada

- Therefore no bookkeeping necessary

- Tax-free shopping on the Internet (e.g. software, tools, courses) --> no physical products!

Highly respected and reputable despite offshore company abroad!

If you already have German customers or plan to generate German customers as a digital nomad, then you don’t need to worry about invoicing with a Canada LLP. Canada enjoys a good reputation. Therefore, no customer will reject your invoice because it was issued by a Canadian company.

Unlike Canada, countries such as Panama or the Cayman Islands, for example, are not regarded highly and are not welcomed by German tax authorities.

However, if the German tax office has no problem with the annual taxation of your customers in Germany, then your customers from Germany or another country will also have no problem.

You can issue an invoice in the name of your Canada LLP as normal. With regard to VAT, make the following note in the invoice text, as you are invoicing from a third country:

“Reverse charge procedure! Reference is made to the tax liability of the recipient of the service in accordance with § 13b UStG. The tax rate is 19 %.”

With this sentence, you point out to your customer that you are not allowed to show VAT as a separate amount. This makes your invoice completely legitimate. This sentence is not mandatory, but it makes many things easier!

Note: Should your client / customer, for whatever reason, ever doubt the authenticity of your company, you can confidently refer him to this page:

https://orgbook.gov.bc.ca/search

Here your customer or client can search for your company using your company name or registration number. This link leads to OrgBook BC. It is a public directory of organizations that are legally registered in BC, Canada. It is a Digital Trust initiative of the Ministry of Citizen Services.

The right bank account for a newly established company abroad

Of course, you also need a bank account into which you can deposit your sales. If you want to open a Canadian bank account in CAD currency for your Canada LLP, this is possible. However, you can also save yourself the trouble of flying to Canada for this purpose.

After all, we want to be as digital as possible and are therefore moving away from traditional bank accounts.

Wise (formerly TransferWise), for example, offers you a more advanced and legally valid company account. Opening an account here offers you a number of advantages:

- It is completely free to use

- Over 52 different currencies are available at Wise

- You can have your customers transfer invoice amounts to you in euros

The last point in particular is useful and easy for your customers. Instead of a foreign account in Canada, you can simply offer them the IBAN of a European account in Belgium as a payment account. This way, your customers can make transfers in euros as usual.

In addition to this advantage of Wise, there are of course many more. With Wise you can hold and exchange over 40 different currencies. You can offer your customers bank accounts in euros, British pounds, Hungarian forints or US dollars. You can find out more about Wise here.

Would you prefer to be a non-resident perpetual traveler or a resident abroad?

If you are traveling, you can choose one of these two options. However, if you work as a freelancer, you should first think about how this will look when invoicing your clients.

Which billing address should be stated on your invoice? Invoicing without a permanent address is rather difficult.

It doesn’t make a really serious impression if the address travels around the world with you. A reputable and proper company name is now at the latest conducive.

If you do not have a suitable place of residence, it is certainly helpful if you can now provide a company address. This makes a much better impression and creates greater trust with your customers abroad.

Founding a company abroad: With the Canada LLP – Part 1

Setting up a Canada LLP is fairly straightforward. That is one of the major advantages. If you are not on site yourself, you can simply hire a formation agency.

Initially, all you need to set up the company in Canada are the names and current addresses of the partners. When applying for the Canada LLP, the company shareholding in % should also be stated. In addition to the desired company name, a second company name should also be specified if the first is not approved.

The incorporation agency then forwards the information to the Canadian government for a name check. This can take about 1-2 weeks.

03.09.2024 Update: Since the British Columbia Business Registration Office is currently experiencing a very high volume of registrations, the name check can currently take up to 20 working days! For this reason, we have decided to offer a priority service, which allows the complete company registration including name check to be completed in about 2-5 working days.

Once the company name has been checked and approved, nothing stands in the way of registering the company abroad.

However, it is important that an official company address or company address exists. If this is available, the agent of the incorporation agency can register the Canadian offshore company abroad under the desired and confirmed company name.

A PO Box is not permitted as a company address. A registered office is required for the company. This means a “Registered Office”, not a branch office!

Anytime Mailbox offers a very simple and legal solution.

Company address abroad with Anytime Mailbox for your Canada LLP

Adding a company address with Anytime Mailbox works directly online. You simply register online with the company name. You will then receive a correct Canadian address with street and house number.

This address can be used as the official address of the company and is then the official company address.

The address and delivery of letters can be monitored via an app. If mail is received, it is possible to instruct Anytime Mailbox to open the letters, scan them and send them online.

Here you can download a Create company address with Anytime Mailbox. We believe that even the cheapest package is completely sufficient. Because if you do your business online, you will rarely receive mail here.

Founding a company abroad (Canada LLP) – Part 2

Once you have done this, you will have received your official company address. You can now inform your start-up agency of this address in order to complete the registration process.

It takes about 2-3 weeks from registration to receipt of all permits and documents.

03.09.2024 Update: Since the British Columbia Business Registration Office is currently experiencing a very high volume of registrations, the name check can currently take up to 20 working days! For this reason, we have decided to offer a priority service, which allows the complete company registration including name check to be completed in about 2-5 working days.

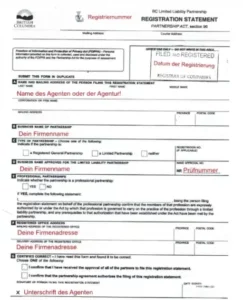

You will then receive the “Registration Statement” for a BC Limited Liability Partnership with the following data:

- The official registration number stamped

- A confirmation of your company name with verification number

- The exact time of registration approval

- Confirmation of your registered office (address)

-

Data can also be viewed in the public register !

Please note: The partners are not listed on the document you receive. One advantage of BC LLP is that the partners are completely anonymous. Only the applicant (agent) and signature are noted on the registration document.

In this regard, the applicant must check a special box stating that he/she is authorized to carry out the registration on behalf of the future partners. The document is then stamped by the BC Registry Service.

The stamp indicates the date of registration. A second stamp contains the company’s 7-digit registration number. The opening of the company is now official!

Canada LLP Partnership Agreement

The partner agreement is the most important part. This official agreement of a Canada LLP contains the registration number in the province, the company name and the date of incorporation and also specifies essential things such as profit distributions, meetings and vacations.

For example, the amount of the profit shares of both partners can be specified here. For example, it is possible to give yourself 99.9% of the shares, while 0.1% of the profit share goes to your partner. We’ll tell you why that’s not a bad idea in a moment!

The contributions are also set out in this agreement. It is noted which partner has invested how much in the partnership. This is important should the partnership be dissolved.

The partnership agreement becomes legally valid when both (or several) partners sign it. Each partner can now confidently pursue their entrepreneurship.

Is it a disadvantage that the Canada LLP requires at least 2 partners?

For lone fighters or digital nomads traveling alone, it could be perceived as a disadvantage that the Canada LLP requires at least 2 partners. However, finding a suitable partner is not that difficult.

The company and therefore the online business can also be managed alone. Only a second signature is required. This can come from a family member, a good friend or your spouse, for example. You can also give your partner a 0.1% share or even 0%. They will not be liable with their private assets.

Advantage for both partners: Even if your partner is not directly involved in your business, they have nothing to fear. As your partner is not liable for you, they are legally protected. You can thank your partner with a small profit share and enter this in the partnership agreement. This way, your partner will be happy about some easy money!

Disadvantage for your partner: If your partner is resident in Germany, he is obliged to register the company in Germany (within one month). This may result in income tax, corporation tax and trade tax being due. However, if you set the profit share in the partnership agreement to 0.1% for your partner, then he may fall under the exemption limit. Please contact the trade office in advance to find out how a 0% shareholding by your partner affects the obligation to register in Germany.

If your partner is already deregistered from Germany and no longer resides in Germany, this company does not have to be registered in Germany either.

Taxes in Germany due to company abroad?

Depending on how much profit you make with your online business, your partner may not have to pay any taxes in Germany at all according to paragraph 9 of the Foreign Tax Act:

§ Section 9 AStG Exemption limit for mixed income: For the application of Section 7 (1), income for which a foreign company is an intermediate company is to be disregarded if the underlying gross income does not exceed 10 percent of the company’s total gross income, provided that the amounts to be disregarded for a company or a taxpayer do not exceed a total of EUR 80,000.

As the individual case must always be taken into account, it is best to find out about certain exemption limits from the tax office, the trade office or your trusted tax advisor.

If your partner has only been set to the profit share of 0.1% to be on the safe side, you can also express your gratitude through gifts, for example. It is even possible to set the partner to 0%! This makes the partner a silent partner without power, so to speak. It should always be clarified in advance whether the partner still has to register the company in Germany.

Attention! If your business partner lives in a country without foreign tax laws or is traveling with you, your partner will not suffer any disadvantages.

You’re ready to go: Your offshore company abroad – Part 3

Once all the formalities have been clarified with the partners in the partnership agreement and all the documents have been signed and sealed, you can now get started with what you want to do.

Think about opening a bank account, preferably with Wise!

An annual tax return and bookkeeping are not required. However, you should remember to file an annual declaration with the Canadian government. Your agency can also do this for you. This is a simple reporting process.

A document must be filled out and then sent to the government in British Columbia. An annual fee is due for this, which must be enclosed with the letter by check or in cash. Please note that only Canadian dollars are accepted!

Requirements for your Canada LLP!

To help you get the most out of your company in Canada, here is a short guide on what you should do and what questions you should ask yourself:

- Will I live in Germany or will I deregister?

- Will I not live in Canada to avoid income tax?

- Will I live in a country that has no foreign tax laws (CFC Rules)*?

- Am I moving to a country with territorial taxation or no direct taxation?

- Don't I have clients in Canada to avoid the withholding tax?

- What is the best way to open a corporate account with Wise (formerly TransferWise)?

- Do I book my company address with Anytime Mailbox? (Mandatory if no address in British Columbia is available!)

*Countries without foreign tax laws and add-back rules (CFC rules)

If you wish to live in one of these countries, then a British Columbia LLP in Canada is particularly worthwhile. This is because no add-back taxation or CFC rules apply here. This means you save on trade tax and corporation tax, as they are not offset in the countries listed below:

Belgium, Bulgaria, Chile, Ecuador, Gibraltar, Hong Kong, Ireland, Colombia, Croatia, Luxembourg, Malaysia, Malta, Mauritius, Poland, Philippines, Romania, Saudi Arabia, Switzerland, Singapore, Slovakia, Thailand, Czech Republic, Ukraine, Vietnam, Cyprus and many more. (Status: 2022)

If you are aware of these things, nothing stands in the way of setting up your own Canadian company with British Columbia LLP.

How much does it cost to set up your Canada LLP through an overpriced agency?

In the event that you are not in Canada yourself and are therefore unable to apply for incorporation on your own, you can use a start-up agency instead.

Most German and English-speaking agencies charge around EUR 2,000 and more for the formation of a Canadian LLP.

Furthermore, the annual report costs around 1,000 euros per year. This report is there to confirm that the company still exists and that all the company’s information is still correct. This must be confirmed by the agency or you of the province of British Columbia. If this annual report is not made, your LLP will be deregistered and you will no longer have a company abroad.

Therefore, always make sure that you complete the annual report or have it completed on time.

The cost of the annual report, like the cost of incorporation, must be paid in Canadian dollars (CAD) either in cash at the time of submission or by submitting a check in CAD currency at the same time.

It is relatively cumbersome to take care of renewing the company name in Canada and making payments on your own. For this reason, incorporation agencies are very helpful, as they take care of all processes such as payment in CAD.

Is the formation of a Canada LLP too expensive for you?

If you offset the EUR 2,000 one-off formation costs against the tax savings that result over the years. Then you can really say that setting up a company abroad is very inexpensive.

No minimum capital is required to found a company. There is also no minimum capital contribution of 25,000 euros compared to a German GmbH.

If the formation of a Canada LLP still seems too expensive, you now have 2 further options:

1. you fly yourself to the province of British Columbia to Vancouver in Canada and take care of everything yourself, or

2. you book the service via RM Digital Life / Us!

How much does your LLP registration with RM Digital Life cost?

-

One-off 995,- Euro for the registration including name application of your own LLP, instead of 2.000,- Euro as with other agencies!

-

Annually 349,- Euro (optional!) for the annual report, which you can book through us, instead of 1.000,- Euro!

- Name check in approx. 15-25 working days**

- Registration in approx. 15-25 working days**

- Complete registration of your LLP in about 6-8 weeks

Before you continue with the booking of our service, we would like to draw your attention to our General Terms and Conditions (AGBs) and ask you to read them through.

- Name check in approx. 48 hours* (on working days!)

- Registration in approx. 15-25 working days**

- Complete registration of your LLP in about 4-5 weeks

Before you continue with the booking of our service, we would like to draw your attention to our General Terms and Conditions (AGBs) and ask you to read them through.

- Name check in approx. 48 hours* (on working days!)

- Registration in approx. 48 hours* (on working days!)

- Complete registration of your LLP in 2-5 working days!

Before you continue with the booking of our service, we would like to draw your attention to our General Terms and Conditions (AGBs) and ask you to read them through.

- This makes contracting with RM Digital Life the most affordable way to open an LLP in British Columbia! We will get everything ready for you so that you can start your online business as quickly and easily as possible!

- Compared to other German-speaking agencies, you save over 1,000 euros for registration and over 650 euros for annual renewal!

These packages must be selected or added separately on our booking page at Digistore24! Pre-selected is the regular LLP formation with the normal processing times through the registration office in British Columbia.

*This information has been officially confirmed to us by the respective institution, but is based on average values. It can happen that this value deviates upwards or downwards, sometimes less and sometimes more. Please take this into account!

**The regular name check as well as the final regular registration time is subject to quite strong fluctuations. Sometimes the result is available in 15 working days and sometimes it takes up to approx. 25 working days! Please allow for these fluctuations in your schedule. If you want to register at short notice, it is best to choose the speed option!

ATTENTION: You must book the company address yourself AFTER a successful name check, e.g. with Anytime Mailbox!

Canada LLP: Let us incorporate your company abroad!

Our service – We take care of it for you:

- Applying for a name check including a preliminary check by us

- And the simultaneous payment of the name check in CAD

- We register your LLP with the BC registration office (speed option possible!)

- At the same time, we pay the fee directly on site in Canadian dollars (CAD)

Your company documents – what you get from us:

- The BC Limited Liability Partnership “Registration Statement”

- The LLP partnership agreement (Limited Liability Partnership Agreement)

- A direct link to the company registration entry in the public register of BC

Tip: Since June 2021, you have the option of checking your registration online via the British Columbia government website. This database was created by the Canadian government in British Columbia to publicly list all companies.

This makes it easier for you to prove the existence of your company to payment providers or banks, for example. This is particularly positive. However, the “Registration Statement” is usually sufficient for this. You can access the blockchain-based database at the following link

https://orgbook.gov.bc.ca/en/home

The best thing is that no personal or private data about you is disclosed. This is because no personal data is made public for the establishment of an LLP.

Book Canada LLP formation now!

Important! Think about which English company name best describes your company. Please also think of a second and third desired company name as a variation in case the first company name is rejected by the British Columbia government.

Your company name should represent something special and unique. Also remember that the abbreviation LLP (Limited Liability Partnership) must appear after the actual company name.

The company name can, for example, consist of a name abbreviation followed by the area of activity. For example, if you have an online shoe store, the name could be “Meier Shoe Store LLP”. The name “Shoe Store LLP” would not work, as the name is not unique enough.

You can find out what you should look out for when choosing a name in our FAQs. You will also find further questions that we have answered and that might interest you!

Summary of your Canada LLP formation!

- 100% legal company in Canada!

- Entrepreneurial freedom guaranteed worldwide!

- Run a company from abroad with peace of mind!

- Company structure without withholding tax!

- Perfect for digital nomads!

- Tax-free income abroad!

- Own company and still flexible!

- Applying for a name check including a preliminary check by us

- And the simultaneous payment of the name check in CAD

- We register your LLP personally with the BC registration office (speed option possible!)

- At the same time, we pay the fee directly on site in Canadian dollars (CAD)

- The BC Limited Liability Partnership "Registration Statement" for download

- Download the LLP partnership agreement (Limited Liability Partnership Agreement)

- A direct link to the company registration entry in the public register of BC

- You need at least 1 partner to sign the partnership agreement after 6 months at the latest (Canada LLP = 2 partners minimum)

- You should not live in Germany and deregister! (because of taxation!)

- You shouldn't live in Canada so you can avoid income tax!

- You should live in a country that has no foreign tax laws (CFC rules)!

- It's best to move to a country with territorial or no direct taxation!

- You have no clients in Canada to avoid the withholding tax

- Ideally, you should open your company account with Wise (formerly TransferWise)

- Book your company address with Anytime Mailbox (mandatory if you do not have an address in Vancouver / British Columbia!)

- Name check in approx. 15-25 working days**

- Registration in approx. 15-25 working days**

- Complete registration of your LLP in about 6-8 weeks

Before you continue with the booking of our service, we would like to draw your attention to our General Terms and Conditions (AGBs) and ask you to read them through.

- Name check in approx. 48 hours* (on working days!)

- Registration in approx. 15-25 working days**

- Complete registration of your LLP in about 4-5 weeks

Before you continue with the booking of our service, we would like to draw your attention to our General Terms and Conditions (AGBs) and ask you to read them through.

- Name check in approx. 48 hours* (on working days!)

- Registration in approx. 48 hours* (on working days!)

- Complete registration of your LLP in 2-5 working days!

Before you continue with the booking of our service, we would like to draw your attention to our General Terms and Conditions (AGBs) and ask you to read them through.

These packages must be selected or added separately on our booking page at Digistore24! Pre-selected is the regular LLP formation with the normal processing times through the registration office in British Columbia.

*This information has been officially confirmed to us by the respective institution, but is based on average values. It can happen that this value deviates upwards or downwards, sometimes less and sometimes more. Please take this into account!

**The regular name check as well as the final regular registration time is subject to quite strong fluctuations. Sometimes the result is available in 15 working days and sometimes it takes up to approx. 25 working days! Please allow for these fluctuations in your schedule. If you want to register at short notice, it is best to choose the speed option!

ATTENTION: You must book the company address yourself AFTER a successful name check, e.g. with Anytime Mailbox!